Executive summary

Executive summary

Industry clinical trials bring widespread benefits to patients, the NHS and the economy.1 Less than a decade ago, the UK was the leading European destination for industry clinical trials. However, partly because of the UK being at the global forefront of Covid-19 clinical trials, its post-pandemic trials recovery has been slower than other countries.

In 2022, the ABPI Clinical Trials Report2 signalled that the UK had reached a tipping point as a destination of choice for industry clinical trials. Since then, the focus on industry trials within the government has increased, from Lord O’Shaughnessy’s commissioned review3 of commercial clinical trials, to the Prime Minister’s recent commitment to reducing clinical trial set-up times in England from 250 to 150 days by March 2026.4 The government’s ambition to grow the UK commercial trials portfolio has been re-stated in the 10 Year Health Plan for England5 and the Life Sciences Sector Plan (LSSP).6

To deliver on these commitments, the government has implemented a series of measures seeking to restore the UK’s clinical trials standing. These activities, overseen by the cross-sector collaborative UK Clinical Research Delivery (UKCRD) Programme,7 have been complemented by the £300 million Voluntary Scheme for Branded Medicine Pricing, Access and Growth (VPAG) Clinical Trials Investment Programme.8 The Investment Programme public-private partnership is the largest ever injection of funds dedicated to boosting commercial research capability in UK history and is a unique opportunity to grow the UK’s share of global industry trials.

The ABPI annual clinical trials report is an important barometer of the UK’s competitiveness in attracting industry trials over time. The past two reports have shown a gradual increase in the number of industry trials initiated in the UK, including some improvement in global competitiveness ranking for phase III trials in 2023. Despite emerging signs of recovery, the number of participants taking part in industry trials declined in 2023 and less than 30 per cent of industry trials recruited the agreed number of participants within the contracted timeframe, mostly due to persistently slow start-up times.9

Data in this report show:

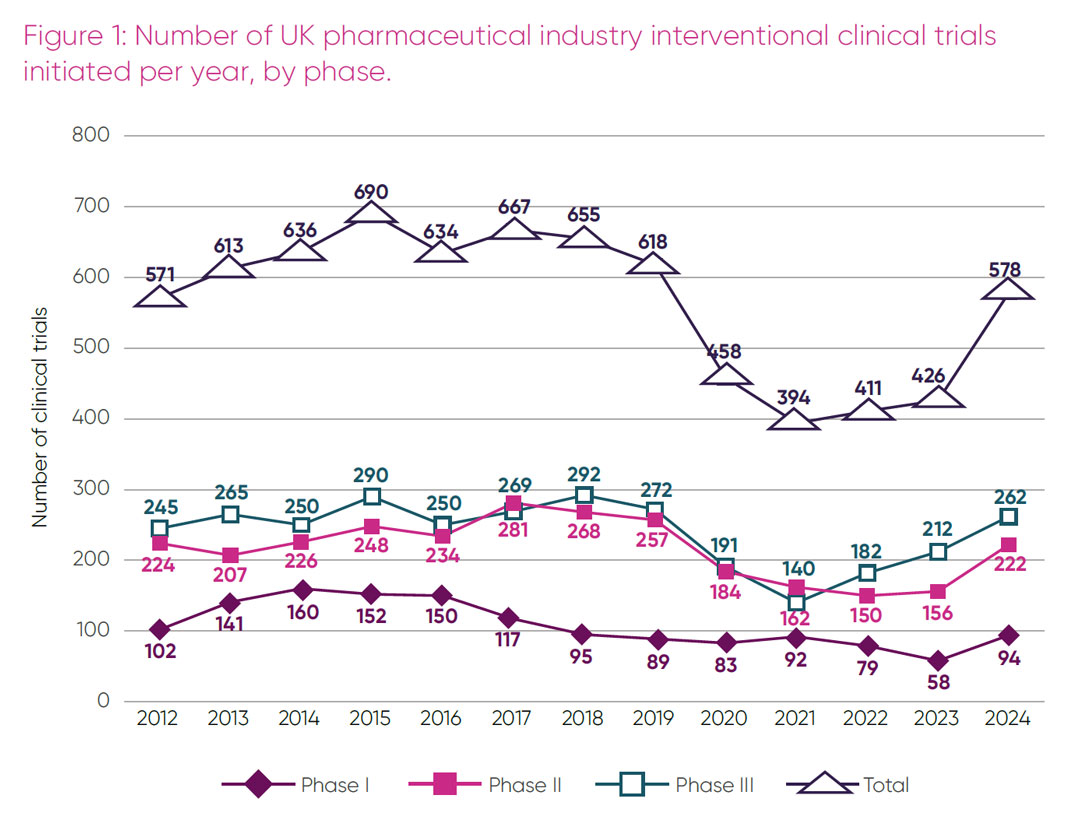

- a 35.7 per cent increase in trial initiations in the UK in 2024 (with 578 trials initiated, up from 426 in 2023)

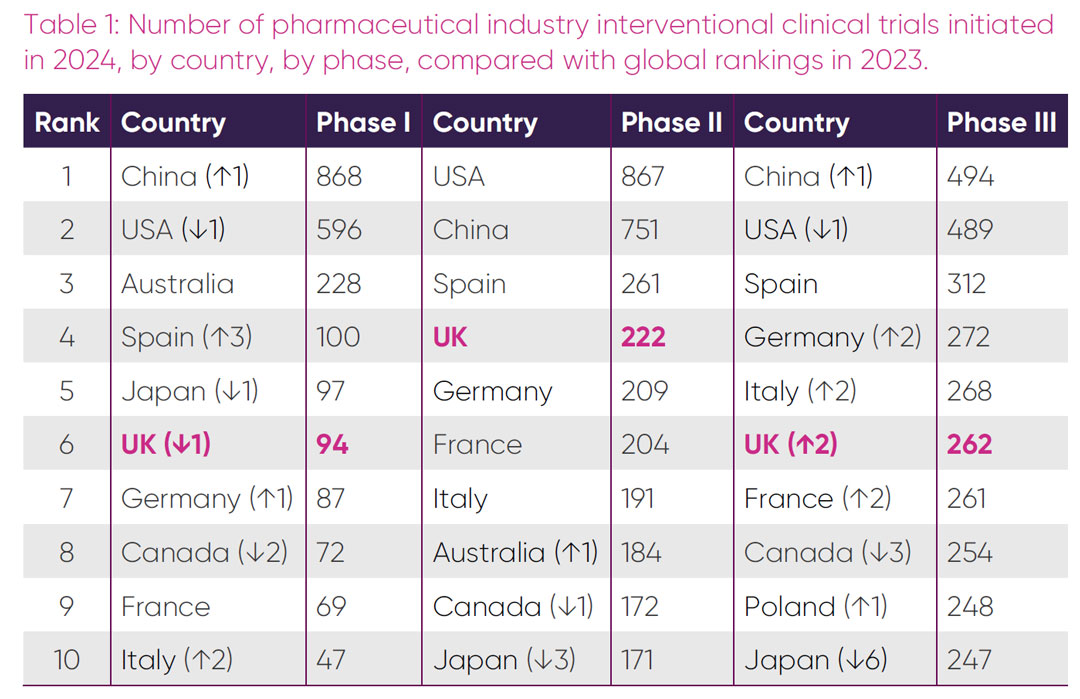

- a rise in UK global competitiveness ranking for initiation of phase III trials, from eighth place in 2023 to sixth place in 2024

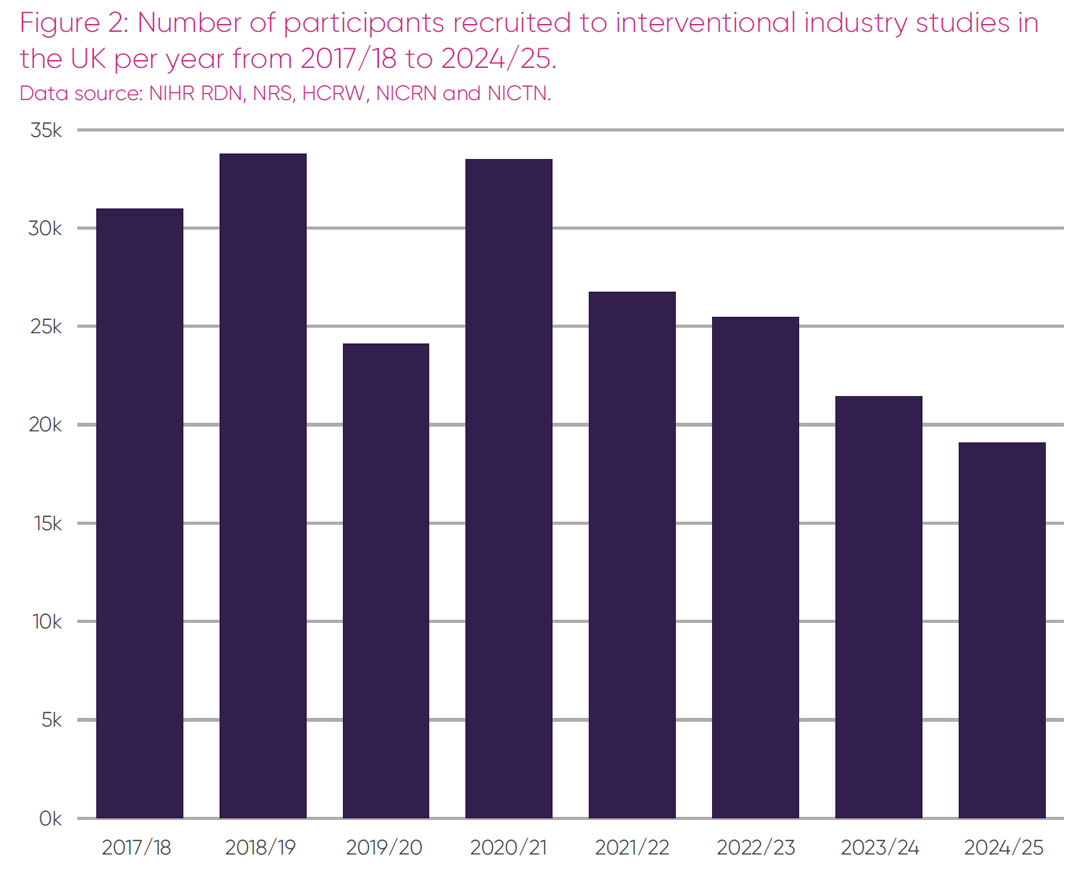

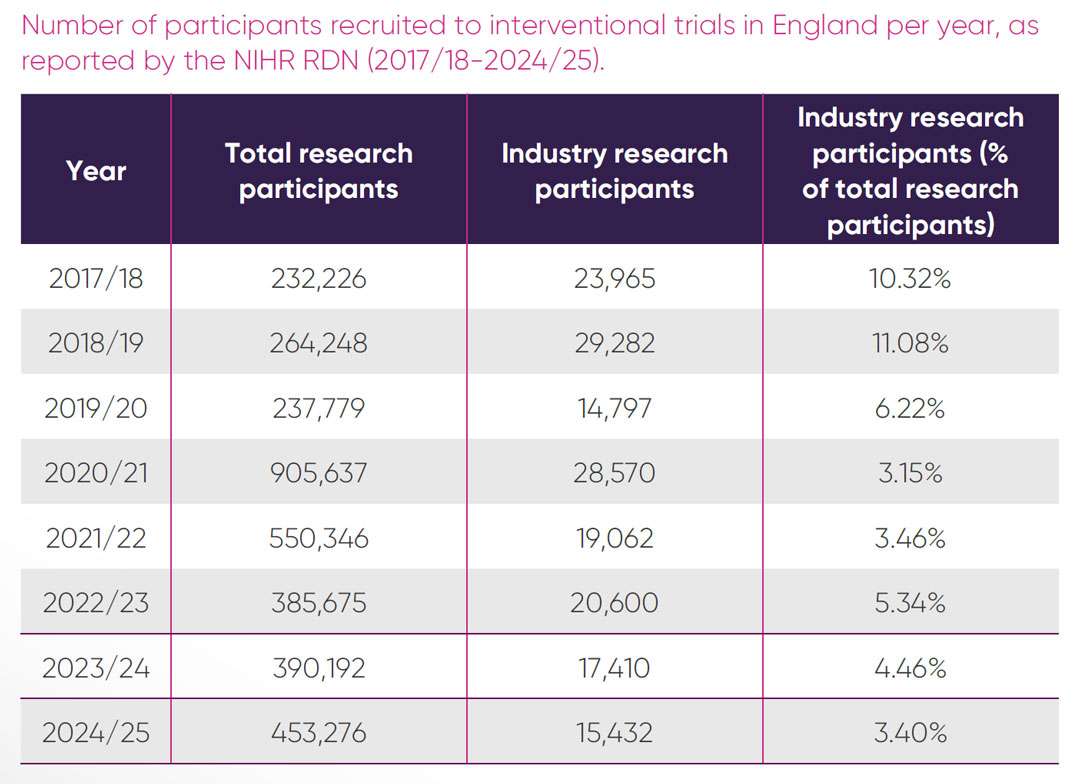

- the number of patients recruited to UK industry clinical trials in 2024/25 fell for the fourth year in a row to 19,092, which is the lowest number since 2017/18

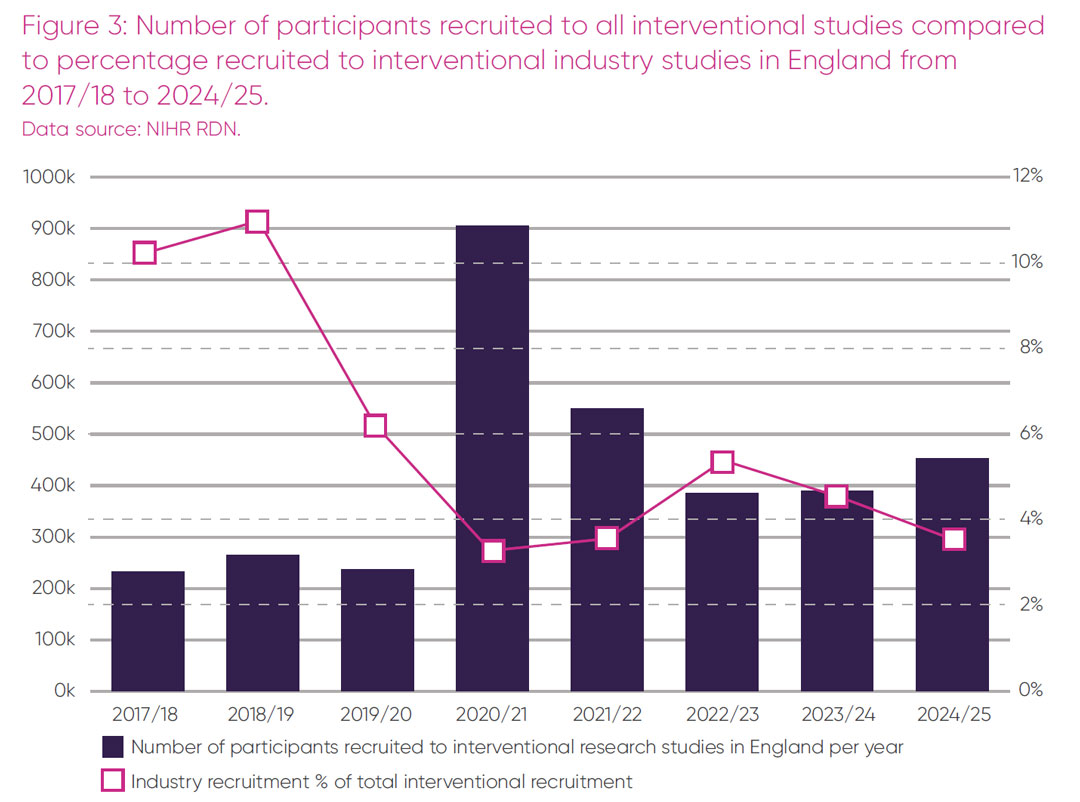

- only 3.4 per cent of all trial participants in England in 2024/25 were recruited to industry trials in the NHS

- the proportion of sites opening to recruitment and recruiting their first participant remained well below the 90 per cent target, averaging 27 per cent and 41 per cent, respectively

- that while in 2024 the UK remained in the top 10 countries for proportion of all phase II and III industry trials initiated with sites in the UK’s strongest therapeutic areas, the increasing dominance of China in placement of trial sites is evident

- in 2024, for the first time, Spain was the leading European country for initiation of all trial phases.

Global investment decisions by the pharmaceutical industry are multifactorial. In the case of clinical trials, speed of regulatory approvals, start-up times and patient recruitment are key factors in country selection decisions. However, there are also wider determinants including talent and scientific base which, together with commercial considerations such as financial incentives, reimbursement and patient access, influence a country’s overall attractiveness for investment.9 A consistent message from ABPI members is the urgent need to improve the reliability and performance of the UK’s clinical trials environment.

Tracking trends in trials initiated in the UK alone, without taking other vital factors into consideration, would not be an accurate reflection of the comparative competitiveness of the UK as a preferred global site. The observed increase in the number of trials initiated in 2024 is a necessary but insufficient indicator of an improvement in the UK clinical trials environment, which has to be matched by an increased number of participants recruited to those trials. Disappointingly, this report shows a year-on-year decline in participant recruitment. This is not only inefficient and costly for sites and sponsors but is selling patients short of the opportunity to participate in studies of the latest therapeutic innovations. The urgent need to address this situation is compounded by persistently slow set-up times and an unfavourable commercial environment in the UK, which further deters inward investment.

We welcome recent government interventions to improve the UK environment for industry clinical trials. However, to effectively address the issues set out above, we recommend further, concerted government action in four essential areas: setting and meeting higher recruitment targets; accelerating set-up times; executive-level accountability across the NHS; and demonstrating the impact of the VPAG Investment Programme.

We hope the insights and recommendations in this report help translate government action into tangible impact for the UK commercial trials environment.

Key messages and recommendations

Key messages:

- Despite an upswing in the number of new commercial clinical trials in the UK in 2024, there is a continuing decline in the overall number of patients recruited into commercial trials.

- The UK’s record of slow clinical trial set ups, together with low patient recruitment numbers, are raising costs and lowering the efficiency of running commercial trials in the UK compared to European and international peers.

- The government and NHS leaders must urgently address these factors to ensure the UK remains a competitive location for commercial clinical trials, which generate valuable income for the NHS, and allow UK patients to benefit from participating in cutting-edge medical research.

Recommendations

We welcome recent government interventions to improve the UK environment to industry clinical trials, however, to remedy this critical situation, we recommend concerted government action on four essential areas:

Introduction

In 2024, the ABPI commissioned Frontier Economics to evaluate the value that industry clinical trials bring to the UK economy, the NHS, patients and research and development (R&D). The report1 demonstrated that, in 2022, industry clinical trials generated £7.4 billion for the economy, including £1.2 billion revenue for the NHS. Industry trials supported 65,000 jobs, 13,000 of which were in the NHS. Almost twice the number of academic papers arising from these clinical trials were in the top 1 per cent of most cited papers, compared to the European benchmark. Most importantly, industry clinical trials offer UK patients the opportunity to access the latest innovative treatments in development, which is particularly crucial where there are no other treatment options available.

The significant value that industry clinical trials bring to health and prosperity is being realised by other countries that have created conducive environments to deliver industry trials.10 International competition to attract industry clinical trials has never been fiercer, which is why the annual ABPI Clinical Trials Report is such an important barometer of the UK’s global competitive standing.

Partly because of the UK being at the global forefront of Covid-19 clinical trials, the UK’s post-pandemic recovery was slower than other countries. In 2022, the ABPI Clinical Trials Report.2 signalled that the UK had reached a tipping point of potential de-selection as a top tier country for placing global industry trials. Since then, the focus on industry clinical trials within the government has markedly increased, from Lord O’Shaughnessy’s commissioned review3 of commercial clinical trials in 2023, to the Prime Minister’s recent commitment to reducing clinical trial set-up times in England from 250 to 150 days by March 2026.4 As a result of government and system mobilisation, the situation in the UK has begun to improve.

The 202311 and 202412 ABPI annual reports show a gradual increase in the number of industry trials initiated in the UK, although these are still well below pre-pandemic levels. The UK’s global competitiveness ranking for phase III trials increased from 10th position in 2022, to eighth in 2023 and rose to fourth for phase II trials in 2023, up from sixth place in 2022. While this may appear encouraging, the number of participants taking part in industry trials declined over this period. In addition, due to persistently slow start-up times, less than 30 per cent of industry trials recruited the agreed number of participants within the contracted timeframe.

Over the past two years, the government has been focused on delivering the O’Shaughnessy review recommendations, through wide-ranging activities overseen by the cross-sector collaborative UK Clinical Research Delivery (UKCRD) Programme.7 The government’s priority to expand the number of commercial trials, increase participant numbers and achieve faster trial set-up times has been re-stated in the 10-Year Health Plan for England5 and the Life Sciences Sector Plan.6

A major component of this ambition will be delivered through the £300 million Voluntary Scheme for Branded Medicine Pricing, Access and Growth (VPAG) Clinical Trials Investment Programme.8 To date, 21 commercial research delivery centres (CRDCs) dedicated to growing capability and capacity to deliver industry clinical trials have been established across the UK, funded by the Investment Programme public-private partnership.

Implementation of these activities is taking place against a backdrop of geopolitical flux and an unfavourable commercial environment for the pharmaceutical industry in the UK. While some government interventions are already yielding positive results, the greatest impact will not be evident until 2026. During the intervening period, it is critical that that government, delivery partners and industry remain closely engaged to shape ongoing changes in the ecosystem to meet industry needs.

As in previous years, this report, which is seventh in the series of ABPI clinical trials reports, includes data on the numbers of trials initiated, the status of UK global competitiveness, participant recruitment numbers and set-up metrics for trials delivered in 2024. For the first time, the report also includes data on UK competitiveness in specific therapeutic areas of UK strength. Finally, the report makes four recommendations, to ensure activities directed at improving the UK commercial trials delivery ecosystem have the maximum desired impact.

Methodology

The data presented in this report includes interventional studies only. Timeframes cover the most recent accurate data available, which range from January 2024 to August 2025. Data presented on commercial or industry trials encompass both pharmaceuticals and devices unless otherwise specified. The data sources, definitions and timeframes are described in full in Appendix 1.

The state of industry clinical trials in the UK

Number of pharmaceutical industry interventional clinical trials

In 2024 the number of pharmaceutical interventional commercial trials initiated in the UK grew from 426 in 2023 to 578 (Figure 1). This was the third year in a row where numbers have risen. Encouragingly, the data showed an increase of 62 per cent in phase I, 42.3 per cent in phase II and 23.6 per cent in phase III, compared to 2023. In 2023, phase I trial initiation, a traditional area of UK strength, was at an all-time low. The observed rise in 2024 is therefore a welcome return to 2018 levels. Despite an increase across all phases, the total number of trials initiated in 2024 was still below the number of industry trials initiated in the UK before the pandemic.

Global ranking by trial initiations

An important indicator of a country’s relative standing in attracting industry trials is the global ranking of new trials initiated per annum. Table 1 shows the global competitiveness ranking for phases I-III initiations in 2024 and trends in comparison with 2023 status.

In 2024, the UK dropped one place in the global rankings for phase I trials, to sixth position. For the first time, the UK is no longer the top European country for phase I initiations, having been overtaken by Spain. Spain leapt three places in the global rankings, with a 133 per cent increase in trial initiations (from 43 in 2023). Despite a 62 per cent increase in the number of phase I trials, the UK reduced its overall market share within Europe. China overtook the USA in the global rankings for the first time, having more than doubled trial initiations from 349 in 2023.

There was no change in global ranking of the top seven country phase II trial initiations in 2024, with the UK maintaining its fourth global ranking position. The 42 per cent rise in trial initiations in the UK is in line with increases observed in other European countries. Although the USA maintained its number one ranking, the number of trials initiated in China doubled from 361 in 2023. The biggest ranking change for phase II trials was Japan which fell three places from seventh to tenth.

The UK’s global ranking for phase III trial initiations climbed from eighth to sixth in 2024. Interestingly, except for Spain, which retained its third place, there was an increase in phase III market share initiations for all top European countries at the expense of Canada and Japan. The increases observed for these countries in 2023 were short lived, with Japan dropping from fourth to tenth and Canada from fifth to eighth. China’s dominance in trial initiation extended to phase III in 2024, having overtaken the USA in the global rankings for the first time.

In 2024, the UK maintained or increased its global share of new phase II and III trials compared to 2023, but lost market share in phase I, predominantly to its European rivals. Spain cemented its dominance as the leading country for all phases of industry clinical trials initiation in Europe, overtaking the UK in phase I initiations. Continuing the observed trends over recent years, the 2024 data suggest that China will soon become the country with the highest number of trial starts across all phases.

Recruitment to interventional industry clinical trials

Participation in industry clinical trials offers participants access to the latest cutting-edge treatments. Despite a 40.6 per cent increase in trials initiated in the UK between 2022 and 2024 (Figure 1), there has been no corresponding increase in number of participants recruitment (Figure 2).

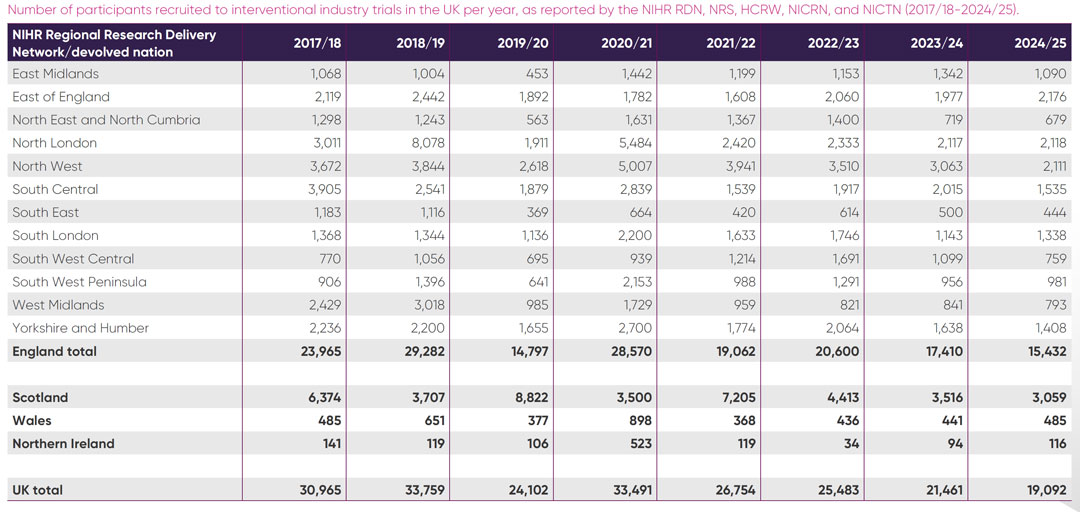

Figure 2 demonstrates there has been a 25 per cent decrease in participant numbers between 2022/23 and 2024/25, during the period where the UK experienced a 40 per cent increase in trial initiations. This marks a fall in the number of individuals recruited into UK industry trials for the fourth year in a row.

Total participant recruitment into all interventional studies in England over time, as a percentage recruited into commercial trials, is presented in Figure 3.

Overall recruitment to all interventional studies in England post-pandemic has grown from 385,675 in 2022/23 to 453,276 in 2024/25. This increase suggests that there is no lack of willingness of patients to participate in trials. However, in contrast to the overall rise in participant numbers, recruitment to commercial trials in the NHS over the same period has decreased and represented only 3.4 per cent of overall recruitment in 2024/25 (Figure 3).

Details of participants recruited to interventional industry studies per year across English regions and the devolved nations is provided in Appendix 2. The 2024 participant figures in Scotland show a similar pattern of declining recruitment to England. Wales and Northern Ireland show increased participant numbers since 2022/23, but the numbers are comparatively small, with 485 and 116 participants respectively recruited in 2024/25.

There may be several explanations for the observed decrease in participant numbers in commercial trials. More complex trial methodologies, including for precision medicines or rare diseases, can have lower recruitment targets than traditional large-scale trials. Combined phase trials, for example phase I/IIb trials, utilise the same patient cohort to evaluate safety, dosage, side effects and efficacy. Where there are limited alternative therapies in areas of high unmet need, the US Food and Drug Administration has expedited development and review programs.13

Increasingly complex commercial trial methodologies may account for some reduction in participant numbers recruited into industry trials. However, ABPI members report that the main explanation is due to UK sites setting diminishing recruitment targets and frequently failing to achieve these targets due to slow trial set-up times.

Speed

Commercial trials recruit globally and therefore lengthy contract negotiations and long set-up times in the UK have a direct impact on how long a UK study is open to recruitment. If European sites open earlier due to fast set-up times or open at the same time and rapidly fulfil or exceed their recruitment quota, the trial will close before slower UK sites have had a chance to recruit their agreed number of participants. In 2022, the median time between regulatory submission and the first dose for the first patient was 273 days for commercial trials in the UK, compared to 231 days in Spain.14 These delays impact the competitiveness of the UK as a reliable delivery site to place clinical trials.

Regulatory approval

The introduction of several approaches to improve the assessment of clinical trials applications by the Medicines and Healthcare products Regulatory Agency (MHRA) in August 2023 has successfully addressed the backlog and previous delays in regulatory approvals. The MHRA is required to provide an outcome for first review and a final decision within 60 days. The proportion of studies receiving a combined review decision within 60 days, measured from submission to the MHRA and Health Research Authority (HRA), over last year was within statuary timeframes, and for August 2025 was 97 per cent.15 However, it should be noted that these figures are a measure of the time that the MHRA and HRA spend assessing an application, rather than measuring the end-to-end process. The ‘clock’ is stopped if a sponsor is responding to a query. Therefore, in reality the overall approval timelines can vary considerably depending on the nature of the queries raised.

A recent evaluation of regulatory submissions to the MHRA between September 2023 and August 2024, found that of 615 initial clinical trial submissions, 86.8 per cent were commercial clinical trials, with 147 phase I, 48 phase I/II, 170 phase II, 223 phase III and 27 phase IV.16 First review within 30 days was achieved in 99 per cent of cases and UK regulatory approval times were comparable with or exceed European timelines.

Despite this encouraging progress on first review, delays in accessing scientific advice due to MHRA capacity issues have had a negative impact on the overall attractiveness of the UK clinical trial research ecosystem. An increased number of advice requests are being progressed as written-only advice. This has been impactful for some industry developers who value timely technical guidance from regulators in face-to-face meetings.

Costing and contracting

The National Contract Value Review (NCVR) is a UK-wide process that was mandated for late-phase trials (phase IIb and above) in October 2023. Since this was introduced, the NCVR process has contributed to a reduction in the time taken to set up commercial studies by 35 per cent.17 From October 2024, the NCVR was extended to cover advanced therapeutic medical products and phase I and phase IIa trials. A series of other changes, such as an unmodifiable confidentiality disclosure agreement template and Chief Investigator Agreement template and guidance on information governance, have been implemented in 2025.27 We welcome the changes designed to streamline negotiations and NHS processes and the constructive dialogue with system partners to address implementation challenges.

Study set-up

The Prime Minister’s commitment to reducing commercial trial set-up times to within 150 days by March 20264 is comprised of following three elements:

- Proportion of regulatory decisions within 60 days.

- Proportion of commercial contract studies that open to recruitment within 60 days of regulatory approval.

- Proportion of commercial contract studies that recruit their first participant within 30 days of opening to recruitment.

Metrics on each of these elements, alongside targets, are published monthly as part of the UK Clinical Research Delivery (UKCRD) Performance Indicators Report.15 Due to lags in data reporting, there is an approximate six-month period where the reported data for the status of site start up and first participant recruitment are in flux. To review performance using the most accurate and stable data available, 12 months of data pre-dating March 2025 have been extracted from the August 2025 UKCRD performance report.

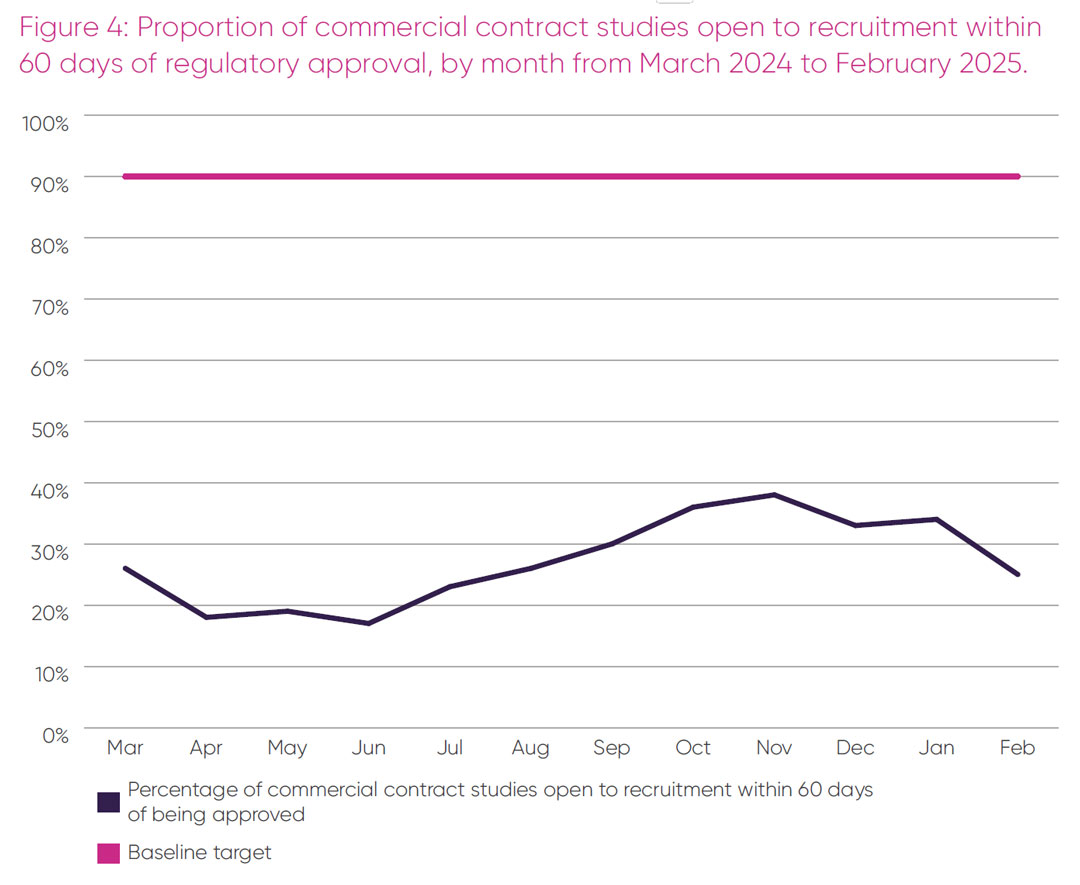

The proportion of industry studies per month that open to participant recruitment within 60 days of receiving regulatory approval, over the 12-month period from March 2024 to February 2025, is shown in Figure 4.

An average of 27 per cent of commercial studies opened to recruitment within 60 days post approval over this period, with no month exceeding 40 per cent of sites open, which is well below the baseline target of 90 per cent.

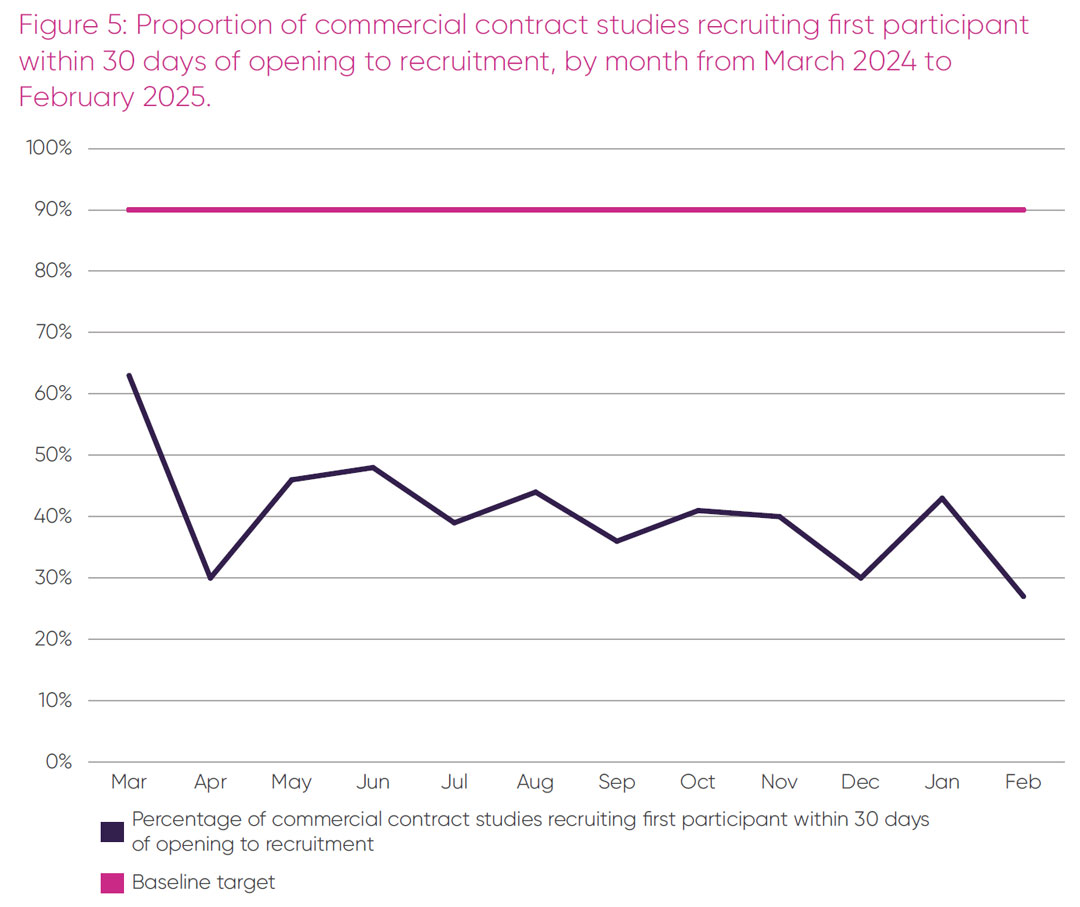

The third element of the Prime Minister’s 150-day set-up target – the proportion of studies recruiting their first participant within 30 days of opening between March 2024 and February 2025 – is presented in Figure 5.

There was variability over the 12-month period from a maximum of 63 per cent in March 2024 to a minimum 27 per cent in February 2025 of industry studies that recruited their first participant within 30 days of opening to recruitment. Over this period, an average of 41 per cent of industry studies recruited their first participant within 30 days of opening, which fell well short of the 90 per cent target. The lack of progress over the 12-month period up to February 2025, when the data are reliable on these two metrics, calls into question whether the 150-day target is realistically deliverable by March 2026.

Study delivery

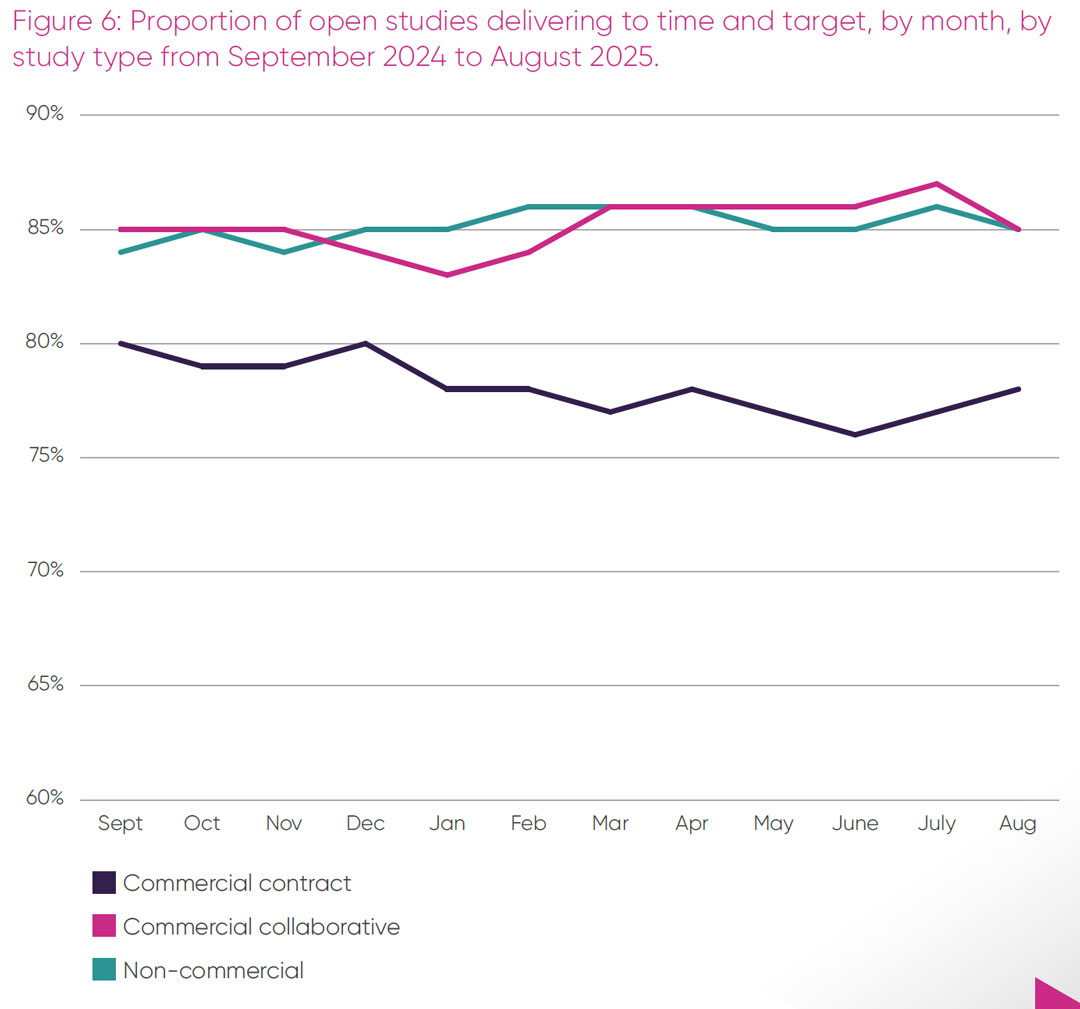

The proportion of open studies delivering to time and target in 2024/25, by month, by study type is shown in Figure 6. This data is published monthly as part of the UK Clinical Research Delivery Performance Indicators Report.15 These data are broken down into three categories:

- Commercial contract studies are studies sponsored and fully funded by industry, including pharmaceutical companies.

- Commercial collaborative studies are studies typically funded, wholly or in part, by industry and sponsored by industry and non-commercial organisations. (This category was included in non-commercial in the 2024 ABPI report).12

- Non-commercial studies are studies sponsored and wholly funded by one or more non-commercial organisations, including medical research charities and public funders.

There is an observable difference between the proportion of open studies delivering to time and target for commercial contract studies, which averages 78 per cent of studies from September 2024 to August 2025, and commercial collaborative and non-commercial studies, both of which delivered at 85 per cent during this period. It is only the commercial contract studies that are below the baseline target of 80 per cent of studies delivering to time and target.

Commercial trials recruit on global timescales, hence slow set-up times will directly cause a failure to recruit to time and target. The effort involved in setting up new study sites is essentially the same whether the trial then proceeds to recruit small or larger numbers, therefore the low recruitment in Figure 2 represents a considerable waste of effort and expense, as well as a missed opportunity for UK patients and lost revenue for the NHS. The data in Figures 4-6 suggest that the core drivers of delays at delivery sites have not yet been addressed successfully for pharmaceutical industry studies.

Global analysis of UK competitiveness by therapeutic area

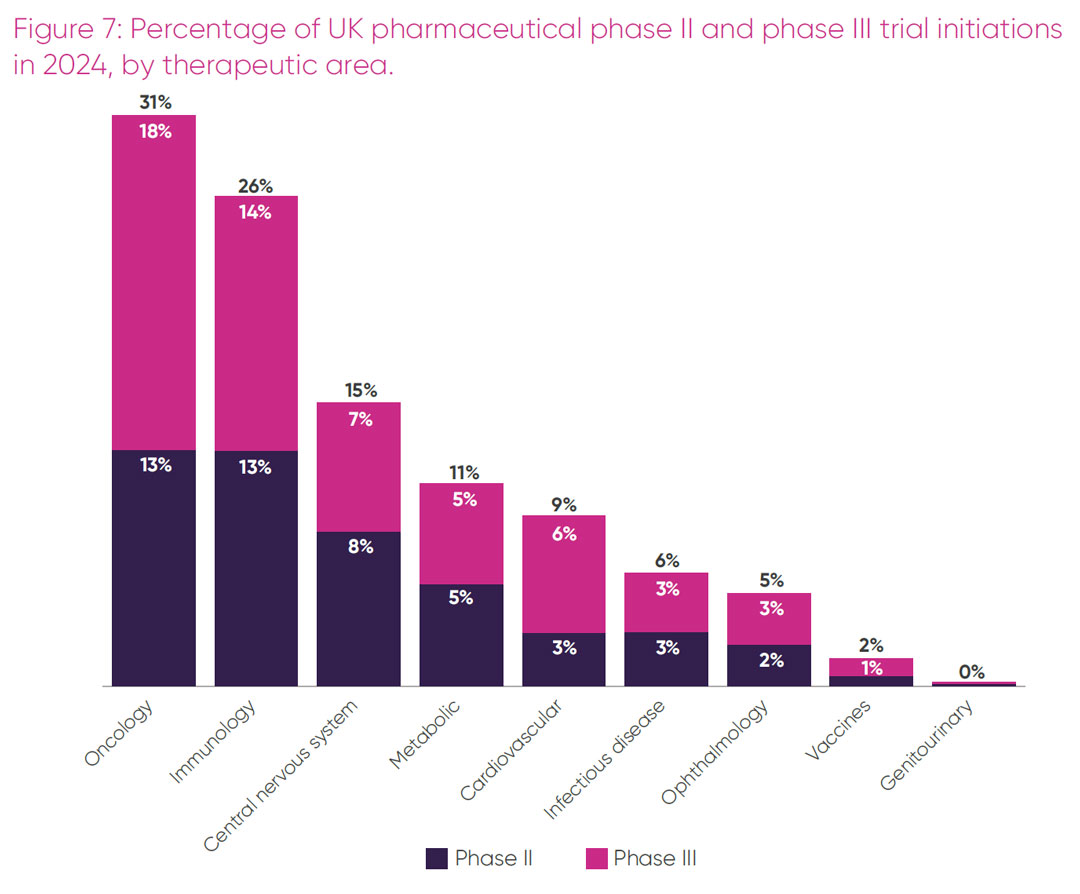

To understand the UK’s strengths and competitiveness in delivering commercial trials in greater depth, the proportion of phase II and III pharmaceutical trials initiated in the UK was broken down by therapeutic area. As illustrated in Figure 7, the top five therapeutic areas in trial initiation in the UK were oncology, immunology, central nervous system (CNS), metabolic and cardiovascular.i Overall, three in every 10 trials in the UK initiated in 2024 were in oncology, with a quarter of all trials in inflammatory diseases. Together these two therapeutic areas made up more than 50 per cent of all commercial trials initiated in the UK in 2024.

i Therapeutic areas for trial initiation denote broad categories, for example, CNS includes neurology, mental health, pain and relevant rare diseases. Immunology includes autoimmune disorders and inflammatory conditions such as asthma and arthritis. Metabolic includes endocrine conditions such as diabetes and obesity as well as hypothyroidism.

Industry clinical trials can either be carried out as multi-country or single country trials. Europe performs relatively strongly in a global context for delivering multi-country trials, where as China’s strength is in single country trials. In 2023, only 6 per cent of all multi-country trials initiation were in China, compared with 19 per cent in Europe.10 The attractiveness of a country for placement of at least one delivery site is one indicator of its competitiveness. This can be determined in different therapeutic areas by measuring whether a country has a trial site(s) as a proportion of all global trials initiated in that therapeutic area, per year.

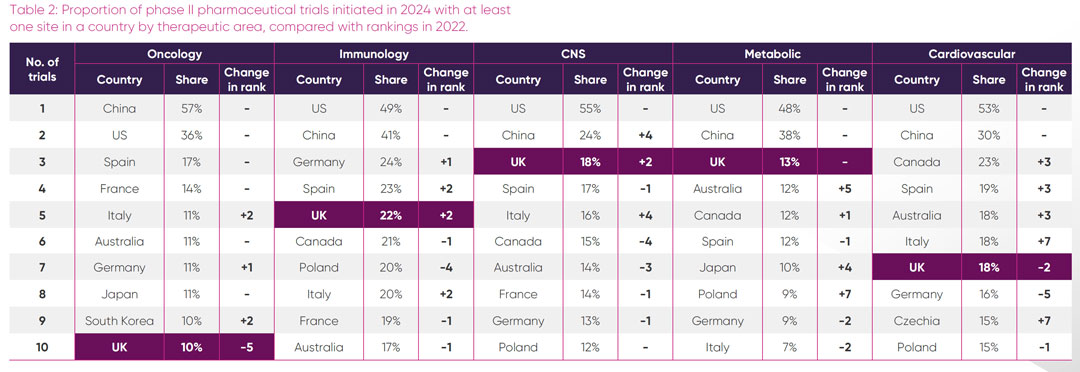

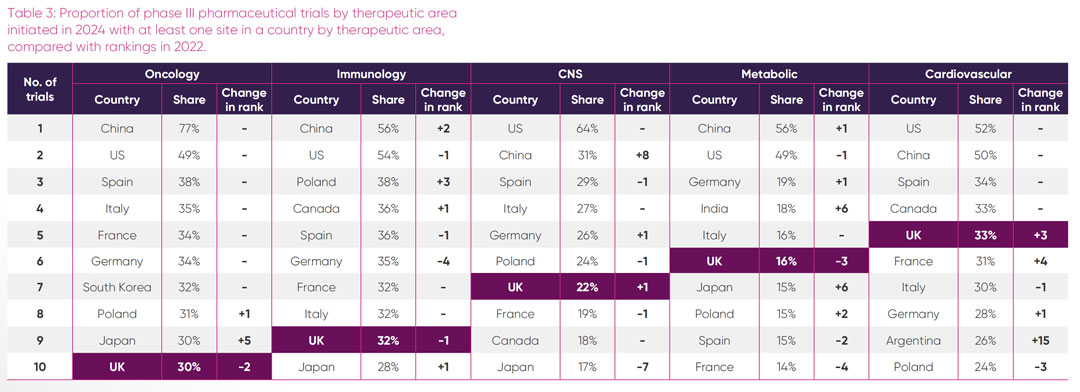

The UK’s relative attractiveness for placement of trial sites in its five strongest therapeutic areas, expressed as a proportion of all pharmaceutical industry phase II trials and phase III trials initiated in those areas in 2024, is shown in Tables 2 and 3 respectively. To monitor recent trends, rankings in 2024 have been compared with 2022.

Key findings

Oncology: the UK hosted sites for 10 per cent of all phase II oncology trials and approximately a third of all phase III oncology trials. In contrast, 57 per cent of all phase II oncology trials and a staggering 77 per cent of all phase III oncology trials initiated globally in 2024 had sites in China. Given the large number of single-country trials that take place in China, a high proportion of these trials may only include Chinese sites, whereas it is likely that the European oncology trials sites are part of multi-country studies. The UK’s share of all oncology trial sites has decreased from the proportion hosted in 2022, in particular for phase II trials, with the UK in 10th position for both phase II and phase III in 2024. Within the top 10 countries, the UK is the only country showing a comparative decrease in global oncology sites.

Immunology: although there was flux in the proportion of phase II trial sites initiated within European countries between 2022 and 2024, the top 10 countries with most immunology phase II trials sites remained the same, with the UK slightly increasing its relative share of sites in 2024. Poland and China made strong gains in hosting more phase III trials between 2022 and 2024. The UK was lowest ranked among European competitors for global proportion of phase III sites.

Central nervous system: the UK was the leading European country with the highest proportion of global CNS phase II trial sites in 2024, increasing two places compared to 2022. However, this did not translate to phase III, where other European countries outpaced the UK in their proportion of global sites. Of interest is the dominance of the US, with 64 per cent of all phase III CNS trials initiated in 2024 having at least one site in the US. Also notable is the rise of trials initiated with sites in China since 2022, suggesting a growing portfolio in this area.

Metabolic: the UK maintained its leading position from 2022 as the European country with the largest proportion of sites for all phase II metabolic trial initiated in 2024. Notably the UK is the only country in Europe in the top five countries for proportion of all phase II metabolic trial sites. For phase III trials, the UK ranked third in Europe for the proportion of all site initiations in 2024 and was sixth overall. Of interest was a steep rise in the proportion of all new metabolic phase III trials in 2024 having sites in India and Japan, jumping six places from their proportion of trial sites in 2022.

Cardiovascular: of the six areas of UK therapeutic strength, cardiovascular was the only one where the UK had a higher proportional ranking of sites for global phase III trials, than phase II trials. For phase II trials, there has been considerable change in the global rankings among countries over the twoyear period, with the UK ranked third in Europe and seventh overall. In 2024 the UK climbed three places in global rankings to fifth with 33 per cent of all global trials initiated in phase III cardiovascular trials having a site in the UK. Of particular note is the dramatic rise of Argentina, which entered the top 10 countries in 2024, having increased its proportional placement of global phase III trial sites by 15 places since 2022.

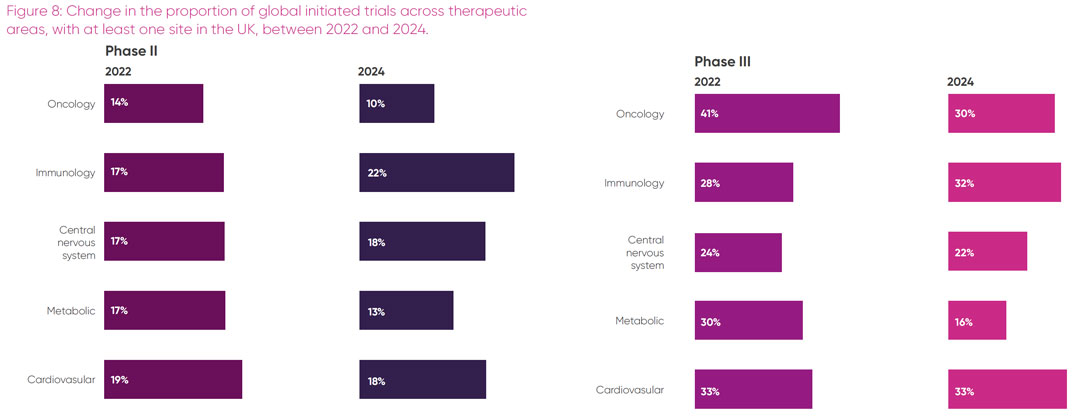

The proportion of all trials initiated in specific therapeutic areas that have at least one site in the UK is clearly impacted by multiple factors, as demonstrated in Tables 2 and 3. However, it is helpful to understand trends within the UK to aid pipeline planning. A summary of the changes in the proportion of trials initiated with sites in the UK’s strongest therapeutic areas over the past three years is shown in Figure 8.

Translating actions into impact

Less than a decade ago, the UK was the leading European destination for placing industry phase I and II trials and was in second place behind Spain for locating industry phase III trials. This was largely due to internationally renowned clinical experts and access to an ethnically and socio-economically diverse patient pool via an NHS single healthcare provider. Partly because of the UK being at the global forefront of Covid-19 clinical trials, its post-pandemic trials recovery was slower than other countries. Over this period, competitor countries gained ground, making policy decisions to increase their market share of industry trials. In parallel, global industry research leaders moved away from default reliance on placing trials at historic sites toward more data-driven decision-making, based on-site trial delivery metrics.

Since the ABPI 2022 clinical trials report2 a raft of government commitments and actions have ensued, seeking to rectify the UK’s global trials standing. Subsequent ABPI reports have demonstrated that these activities have begun to produce improvements. Data in this report show an increase in initiation of all phases of clinical trials in the UK in 2024 and a rise in global ranking from eighth to sixth place for phase III trials.

For the first time, the report presents a deep dive into UK competitiveness in the proportion of all phase II and III industry trials initiated with sites in the UK’s five strongest therapeutic areas. Trends show that while the UK remains in the top 10 countries for site initiations in all these areas, other non-European countries such as China, India, Korea and Argentina are making strong gains.

Site set-up times and the proportion of sites opening to recruitment between March 2024 and February 2025, which corresponds to the most recent period where source data are complete, remain well off target, averaging 27 per cent and 41 per cent respectively. Dramatic improvements in these timeframes will be needed over the next six months if the Prime Minister’s 150-day target by March 2026 is to be realised.

Most concerning of all the data in this report is the fall, for the fourth year in a row, in the number of patients recruited to industry trials.

Tracking trends in trials initiated in the UK alone, without taking other vital factors into consideration, would not be an accurate reflection of the comparative competitiveness of the UK as a preferred global site. The observed increase in the number of trials initiated in 2024 is a necessary but insufficient indicator of an improvement in the UK clinical trials environment if it is not associated with an increased number of participants recruited to those trials. The year-on-year decline in participant recruitment is not only inefficient and costly for sites and sponsors but is also selling patients short of the opportunity to participate in studies of the latest therapeutic innovations. The urgent need to address this situation is compounded by persistently slow set-up times and an unfavourable commercial environment in the UK, which further deters inward investment.

We welcome recent government interventions to improve the UK environment for industry clinical trials, however, to remedy this critical situation, we recommend concerted government action in four essential areas: setting and meeting higher recruitment targets; accelerating set-up times; executive-level accountability across the NHS; and demonstrating the impact of the VPAG Investment Programme.

Recommendations

Set and meet higher recruitment targets

NHS organisations that conduct research have better patient outcomes, including lower mortality, shorter hospital stays and improved patient care experiences.18, 19 Clinical trials provide patients with the chance to take part in research into cutting-edge treatments, which is particularly crucial for conditions that lack alternative treatment options. Despite the 2023 O’Shaughnessy review recommendation to double commercial trial participation, the 2024 data from this report show the opposite trend.

Participant numbers in the UK have fallen for the fourth year in a row to just over 19,092, the lowest number in the past eight years. This decline in recruitment is not observed in non-commercial interventional studies in England. In contrast to industry studies, the total numbers of participants taking part in UK non-commercial interventional studies over the past two years is approximately twice the number recruited into non-commercial studies prior to the Covid-19 pandemic.15.This disparity has resulted in the total number of patients recruited

to industry studies accounting for just 3.4 per cent of all participants in interventional studies in England in 2024.

There are several factors that may explain the declining trend in recruitment into industry trials. Increasingly complex trial designs or trials in rare disease and precision medicine can involve smaller participant numbers. Perverse incentives in performance reporting can deter NHS organisations from setting high recruitment targets for fear of failing to meeting these targets. This can lead to sites committing to recruit increasingly smaller numbers of participants. Companies have reported to the ABPI that between 40 and 50 per cent of sites only recruit one or two participants, which is not only inefficient for the site, but is very costly for the commercial sponsor. Members also report that current recruitment targets set and achieved by UK sites are so low that they are no longer internationally competitive. There is little incentive for global industry to place trials in the UK, when so few participants will be recruited.

There is growing recognition of the need to involve a more representative range of trial participants reflecting the patient population who will ultimately benefit from a treatment. This could be a potential unique selling point for the UK, with its relatively diverse population and NHS single healthcare provider. Once the new clinical trials regulations come into force in 2026, all late-phase trials in the UK should incorporate an inclusion and diversity plan as part of their regulatory submission. To support this agenda, in June 2025 the ABPI and the Association of Medical Research Charities (AMRC) jointly hosted a cross-sector workshop on increasing diversity and inclusion in clinical research.20 The HRA has committed to taking forward one of the recommended actions from the workshop, to develop a UK-wide strategy and roadmap to drive greater diversity and inclusion in clinical trials.21 Steps to widen the pool of patients who take part in research should serve to boost the total numbers of participant recruited into trials.

The Life Sciences Sector Plan (LSSP) reaffirms the government’s commitment to doubling commercial trial participant numbers by 2026 and doubling these numbers again by 2029.6 Activities in the LSSP, such as creating a single searchable database of clinical trials activity in the UK and linking the Be Part of Research initiative to the NHS app in the 10 Year Health Plan,6 will contribute towards making the public and clinicians more aware of clinical trials opportunities in the UK. Future potential to reach a wider diverse population of eligible trial patients could come from establishing a data-enabled clinical trials service, as part of the Health Data Research Service announced in April 2025. A means to significantly increase recruitment into industry trials will be via the CRDCs and Primary Care Commercial Research Delivery Centres (PC-CRDCs) that have a specific remit to grow capability in delivering commercial trials across the UK. Setting more ambitious recruitment targets and consistently delivering to these higher targets must be a priority for clinical trials delivery sites across the UK. Failure to incentivise sites to address this key issue may result in the UK no longer being a competitive option in the site allocation of global industry trials.

Accelerate set-up times

Speed of study set up is a major factor in determining a country’s attractiveness as a preferred destination for delivering global trials. Delays in study set up can result in studies closing early with only a few participants recruited, having lost out to competitors that have already reached or exceeded their recruitment targets.

Spain has recognised the appeal of fast set-up times for attracting more industry trials and consequently is the European leader for the number of new clinical trials initiated across all phases in 2024 (Table 1). To make the EU a more attractive destination, the European Medicines Agency has set a new target whereby two thirds of all clinical trials in the EU should begin recruiting patients within 200 days or fewer from regulatory submission. This is up from the 50 per cent of trials that currently achieve this target.22

A survey of ABPI members in 2024 found that site set up and trial initiation in the UK is too slow compared to competitor countries. Processes are fragmented and duplicated at each site. Several sponsors reported waiting months for individual site approvals, despite having national regulatory clearance. Contracts are delayed by inconsistencies, slow decision-making and negotiations across NHS sites.

Members’ experiences of delays with UK trial set up are borne out by data in this report. Previous issues with delays in regulatory approvals have been resolved, with the MHRA now consistently reviewing trial applications within the 30-day statutory timeframe.16 However, between March 2024 and February 2025, an average of only 27 per cent of commercial studies opened to recruitment within 60 days of regulatory approval, and 41 per cent recruited their first participant within 30 days of opening (Figures 4 and 5). Clearly there is a significant gap to be addressed if the target of 95 per cent of commercial trials in England recruiting their first participant within 150 days of regulatory submission is to be achieved by March 2026.23

Expediting set-up times has been a major focus of government activity in response to the recommendations in the O’Shaughnessy review. The UKCRD programme15 is a UK-wide cross-sector partnership that is responsible for transforming UK clinical trials performance. Significant progress has been made in developing a standardised contract to streamline and de-duplicate assurance processes. As of September 2025, adoption of the standardised contracting process has been mandated by NHS England (NHSE), via the existing national directive for Commercial Contract Research.24 This advance will augment the mandated NCVR process, which has already reduced costing negotiation times by over a third. We welcome the government’s interventions and close engagement with the ABPI and our members during developments, noting that the impact of these changes will take at least six months to have a measurable impact.

Accurately monitoring progress against performance targets depends on timely standardised data collection. Expansion of the monthly published dashboard of clinical trials performance to include English site-level performance data25 in late 2025 reflects the government’s commitment to increasing transparency. Despite this commitment, performance monitoring is being hampered by the absence of a data-collection infrastructure that can produce status reports in near real time.

In late 2025 the Department of Health and Social Care (DHSC) will procure a new digital service that will provide near real-time performance monitoring of research in England. The service will provide insights for industry and other stakeholders on research performance, capability, and capacity in research host organisations. ABPI members are inputting their requirements to inform the DHSC procurement specification. Although this is a welcome development, discussions on a new data IT collection system have been ongoing since 2023, and because of these delays, the new service will not go live until the end of 2027.

Executive-level accountability across the NHS

The NHS, with its globally acclaimed clinical expertise and population-wide coverage, is a major draw for industry clinical research and partnerships. In 2022, industry clinical trials generated £1.2 billion in revenue for the NHS and supported 13,000 NHS jobs.1 Recognition of the value of industry clinical trials to the economy, NHS and patients, and the ambition to increase the UK’s share of commercial clinical research feature in the 10 Year Health Plan and the LSSP.

To deliver the Prime Minister’s commitment to reduce commercial clinical trials start-up times in England to 150 days by March 2026, the government has put in place a series of measures to accelerate and streamline the clinical trials contracting process. This has been complemented by NHSE requesting that trusts fully recover commercial research costs and comply with research income terms and conditions, including reinvesting commercial income into research capability.26

There is a statutory duty for Integrated Care Boards (ICBs) to facilitate research and NHSE’s recently published Medium Term Planning Framework27requires NHS providers to meet the site-specific timeframes of the government’s 150-day clinical trials set-up target. While this is a welcome advance, it is still unclear how ICBs will be held accountable at a regional and national level for their performance against these targets.

The merger of NHSE into the DHSC offers an opportunity to course correct the current disconnect between the government’s ambitions to expedite clinical trials and the absence of senior-level accountability for trial delivery across the NHS. Without the pull-through of local responsibility to national and NHS executive accountability, it is difficult to see how the government’s efforts to streamline processes will have any real traction, or elicit the sizable change needed to transform commercial trials delivery in the NHS. The new revised national operating model provides an opportunity to improve performance metrics and oversight of NHS clinical research targets in the 10 Year Health Plan and the LSSP.

At national level, ensuring the NHS Chief Executive and DHSC Chief Scientific Advisor are equally accountable for delivering the Prime Minister’s 150-day target and ongoing clinical trials performance will bring shared ownership between the NHS and the government. At regional level, the seven regional directors in the new NHSE/DHSC senior structure provide an important accountability link between ICBs and the NHS chief executive.28 At local level, individual trusts and ICBs must have oversight and accountability for trial performance at board level. These shared responsibilities between the NHS and DHSC will enable translation of local NHS trials performance reporting to a regional level, with visibility at the new DHSC Board. It is vital that the same standardised metrics are used at local, regional and national levels and are adopted by the devolved nations to allow meaningful and accurate assessment of commercial trials performance across the UK. This is particularly critical given the imperative for all four nations to report to VPAG scheme members on the impact of the £300 million VPAG Investment Programme funding.

The forthcoming health legislation also provides an opportunity for the government to enshrine the importance of research within the NHS as a core part of care delivery, including duties to deliver, and report on clinical research activities. Experience tells us that for this new legislation to have the desired impact, it will need to be paired with accountability for delivery across all levels of the NHS.

Demonstrate impact of the VPAG Investment Programme

The purpose of the £300 million clinical trials element of the VPAG Investment Programme is to improve the UK environment for delivering industry clinical trials by increasing research capacity and infrastructure.8 The Investment Programme is the largest ever injection of funds to boost commercial research in UK history. The aim of this uplift is to pump-prime improvements in commercial trial delivery in the UK, which should be self-sustaining in the longer term. If the funding is deployed effectively, it should strengthen overall clinical research capacity across the UK and be a key driver in contributing to the government’s goal of growing inward investment in commercial clinical trials.9

Over the course of 2025, VPAG Investment Programme funds have established 21 CRDCs across the UK and a UK-wide CRDC Network, aimed at harmonising processes and coordinating activities across the CRDCs. These centres will increase opportunities for patients to take part in trials of the latest treatments. Although it is still early days for the CRDC Network, it will be essential that the network prioritises working closely with the Research Delivery Network (RDN) and devolved nations to provide a seamless interface for companies to engage with the UK clinical trials delivery ecosystem.

Currently an average of 78 per cent of commercial trials recruit the agreed number of participants within the agreed times (Figure 6). Delays in study set up are a major cause of trials not delivering to time and target in the UK. However, once a trial is underway, delays can occur due to workforce shortages and access to appropriate facilities and equipment. In recognition of the pressures on the NHS research workforce and equipment, Investment Programme funds have also been earmarked to increase capacity, resources and infrastructure to support industry trials.29,30 To assist the government in targeting this funding, the ABPI commissioned an exercise to map members’ trial pipelines, understand the biggest obstacles in delivering trials, and make recommendations that could alleviate these workforce and infrastructure barriers.

Workforce

NHS organisations that are research active have improved staff satisfaction and retention rates in addition to their clinical performance.31 Yet virtually all companies surveyed reported that they had experienced gaps in the NHS workforce that had negatively impacted on UK site selection. Critical workforce shortages were highlighted in key ancillary roles, including radiologists, pharmacists and administrative staff. Radiology shortages had a particularly deleterious impact on oncology trials, which were carried out by 93 per cent of the 15 survey respondents. Similarly, limited pharmacy capacity to support complex trial protocols caused major delays in site start up. Overburdened staff and a high turnover due to short-term contracts exacerbates these challenges.

Industry recommendations for where Investment Programme funding could help address workforce shortfalls included transitioning research staff on short-term contracts to multi-year contracts, establishing mobile regional capability that could deploy resources to fill acute staff shortages, and supporting training placements of final-year radiology and pharmacy students.

The government has not yet fully outlined its plans for how it intends to use the Investment Programme funds to respond to these workforce challenges and member recommendations. Ideally the time-limited Investment Programme funds would pump-prime a wider programme of sustained NHS research capacity-building initiatives. Without this prioritisation, NHS research workforce shortages will persist and undermine government commitments in the LSSP and 10 Year Health Plan.

Infrastructure

Two thirds of companies surveyed in the ABPI mapping exercise cited that they had used equipment and facilities outside the NHS to conduct their trials due to lack of availability within the NHS. Limited access to diagnostic equipment, such as scanners, create bottlenecks in delivery. Space constraints at trial sites, especially in primary-care settings, limit the ability to deliver complex trials.

Commercial research capability within primary care is less mature than the UK’s well-established secondary-care sector. Despite this differential, two thirds of survey respondents were delivering clinical trials in primary care. Resource, training and infrastructure gaps were viewed as limiting primary-care research capability.

To address the infrastructure gaps identified, ABPI members recommended that the Investment Programme funds be used to establish PC-CRDCs, mobile units with screening equipment to enable patient recruitment in underserved areas; and semi-permanent infrastructure with diagnostic equipment in high-demand sites to reduce bottlenecks in trial delivery.

The DHSC has responded to these recommendations via a competition for capital funding in England, in line with areas of infrastructure need identified by industry. In addition, 14 Primary Care Commercial Research Delivery Centres (PC-CRDCs) have been established in England with the aim of building commercial research capability within primary care.32 The PC-CRDCs, along with primary care infrastructure funded within the devolved nations, will be incorporated into the UK-wide CRDC Network to provide an integrated offering across all research settings.

Measuring impact

There is a shared enthusiasm by the government, delivery partners and industry alike to seize the unique potential of the Investment Programme to transform commercial trials delivery in the UK. A series of impact metrics have been agreed by industry and the government to monitor performance of the VPAG Clinical Trials Investment Programme over time. There are raised expectations that the CRDCs will have faster start up times and recruit higher numbers of participants, becoming beacons of best practice across the UK. It will be essential to demonstrate to VPAG scheme members that Investment Programme funds have delivered the intended impact and tangibly improved the UK trials delivery environment. Success will ultimately be determined by whether the commercial trials portfolio has significantly expanded, in conjunction with a major increase in participants taking part in industry trials of the latest treatments.

Conclusion

Commercial clinical trials are a significant driver of economic growth. Over the past decade, Spain has focused on reducing regulatory approval and set up times, which has yielded an average annual 5.7 per cent increase in industry investment in clinical trials in Spain. Germany’s decision to link medicines pricing to a minimum 5 per cent country recruitment target may have partly contributed to a rise in initiation of industry phase III trials in 2024. Despite its relatively small population, Australia’s offer of tax incentives for early stage R&D, combined with regulatory efficiency has maintained its third place global ranking in Phase I trials initiated in 2024, behind the USA and China (Table 1).10

Although there is country-level variation within Europe, over the past five years there has been a trend away from placing trials in Europe in favour of China and Asia. While it may not be possible for the UK to compete with the number of trials initiated in China, with 29 per cent of all phase trial starts in 2023, the vast majority of these were single country trials, with only 6 per cent of all multi-country trials in 2023 initiated in China.10 This still leaves scope for the UK, with its clinical expertise, NHS universal care provider and clinical research infrastructure, to command a much larger share of more complex and multicountry trials.

Global investment decisions by the pharmaceutical industry are multi-factorial. In the case of clinical trials, speed of regulatory approvals, start-up times and patient recruitment are key factors in country selection decisions. However, there are wider determinants including talent and scientific base, together with commercial considerations such as financial incentives, reimbursement and patient access, that influence a country’s overall attractiveness for investment.9

Recently the impact of wider commercial factors have been brought into sharp focus in the UK. An estimated £2 billion of planned pharmaceutical industry investment into the UK life sciences sector has been withdrawn or paused, as a direct result of the UK’s unfavourable medicines commercial environment.33 This is a clear demonstration of the interdependence between the status of the commercial environment and patient access to medicines, and the willingness of global board rooms to commit to R&D investment.

Close collaboration across the government, the NHS, regulators, charities, academia and industry is essential to maintain a thriving UK life sciences sector. Between 2014 and 2024, non-commercial clinical research contributed £72.7 billion to the UK economy, and it plays a vital role supporting the NHS, including boosting NHS research workforce capacity.34 The UKCRD programme is the vehicle that brings all parts of the UK clinical research ecosystem together, with a shared agenda of improving UK clinical trials performance.15 This partnership which includes the pharmaceutical industry, facilitates ongoing feedback, enabling faster implementation of effective solutions.

A consistent message from ABPI members is the need to improve reliability in the UK clinical trials environment, providing companies with the confidence that what has been agreed by sites, is what will be delivered. Currently UK affiliates are having to justify placing trials in the UK to their global colleagues, in the face of evidence of slow study set up, and recruitment rates lagging behind European competitors. The Investment Programme is a unique opportunity for the system to align with industry expectations and restore confidence in UK reliability. VPAG scheme members will be looking to the CRDCs as beacons of excellence, leading UK ecosystem recovery and hitting performance targets.

Industry clinical trials bring widespread benefits for patients and the NHS. Moreover in 2022, commercial trials contribute £7.4 billion to the economy and supported 65,000 jobs.1 Data in this report show an increase in the number of trials initiated in the UK in 2024, however this was not accompanied by a commensurate increase in patient recruitment. The year-on-year decline in UK patients having the opportunity to participate in industry trials, particularly in light of more trials being available, is concerning.

At this time of geopolitical flux, with commercial drivers strongly influencing investment decisions, there is a clear imperative for the government to take action to restore our global competitiveness. We endorse the government’s commitment and activities to re-set the UK as a desirable destination to deliver industry trials. We hope the insights and recommendations in this report help translate government action into tangible impact for the UK commercial trials environment.

Appendix 01: Data sources, definitions and timeframes

Figure 1 and Table 1 add a 2024 snapshot to the previous data published by the ABPI63 on commercial trials (commercial contract and commercial collaborative) related to pharmaceutical drug development and molecular/biological entities in the UK, and leading competitor countries, commissioned from Clarivate’s Cortellis Clinical Trials Intelligence. Trial phases have been grouped to support the simplicity of presentation:

- Phase I includes 1, 1a, 1b trials

- Phase II includes 2, 2a, 2b, 1/2 trials

- Phase III includes 3, 3a, 3b, 2/3 trials

Figure 2 shows recruitment to UK commercial interventional trials as provided directly by the National Institute for Health and Care Research, Research Delivery Network (NIHR RDN) coordinating centre, NHS Research Scotland (NRS), Health and Care Research Wales (HCRW), Northern Ireland Clinical Research Network (NICRN), and Northern Ireland Cancer Trial Network (NICTN) for recruitment between 1 April 2024 and 31 March 2025. Data on commercial observational trials have been excluded. Figure 3 shows a snapshot of the English data on non-commercial interventional trials as provided by the NIHR RDN coordinating centre, broken down by the 12 Regional Research Delivery Networks. The detail of this data is provided in Appendix 2.

Performance data are published monthly by the DHSC and the devolved administrations in the UK Clinical Research Delivery Performance Indicators Reports. Due to lags in data collection, there is an approximate six-month period where the reported data for the status of site start up and recruiting the first participant is in flux. Figures 4 and 5 were extracted from the August 2025 UKCRD performance report to account for the lag between activity and data being recorded in the central system. Figure 6 on the proportion of open studies was taken from the monthly reports from September 2024 to August 2025.

Figures 7 and onwards are an analysis of Citeline’s Trialtrove and are focused on commercial sponsored trials of medicines (not devices or diagnostics). The therapeutic areas in Figure 7 are those with the highest numbers of trials in the UK in 2024 based on Trialtrove data, validated by an internal survey conducted among ABPI members. These areas are consistent with the top five therapeutic areas for forecasted spend in 2029, as per IQVIA’s report ‘Global Use of Medicines Outlook through 2029’.35 Tables 2 and 3 and Figure 8 utilise global percentage share, so even though, as per Figure 1, overall trial numbers have increased substantially between 2022 and 2024, this approach normalises that change to identify the global proportions at the two timepoints.

Appendix 02: Additional data on industry clinical trial recruitment

Appendix 03: Key acronyms

AMRC: Association of Medical Research Charities

CRDC: Commercial Research Delivery Centre

DHSC: Department of Health and Social Care

HRA: Health Research Authority

HCRW: Health and Care Research Wales

MHRA: Medicines and Healthcare products Regulatory Agency

NICRN: Northern Ireland Clinical Research Network

NICTN: Northern Ireland Cancer Trial Network

NIHR: National Institute for Health and Care Research

NIHR RDN: National Institute for Health and Care Research, Research Delivery

Network

NRS: NHS Research Scotland

PC-CRDCs: Primary Care Commercial Research Delivery Centres

VPAG: Voluntary Scheme for Branded Medicine Pricing, Access and Growth

UKCRD: UK Clinical Research Delivery

Endnotes

1 The Association of the British Pharmaceutical Industry, The value of industry clinical trials to the UK - extended report, December 2024

2 The Association of the British Pharmaceutical Industry, Rescuing patient access to industry clinical trials in the UK, October 2022

3 Department of Health and Social Care, Commercial clinical trials in the UK: the Lord O’Shaughnessy review - final report, May 2023

4 Department of Health and Social Care, Prime Minister turbocharges medical research, April 2025

5 Department of Health and Social Care, 10 Year Health Plan for England: fit for the future, July 2025

6 Department of Health and Social Care, Life Sciences Sector Plan, July 2025

7 Department of Health and Social Care, Transforming the UK clinical research system: August 2025 update

8 Department of Health and Social Care, UK secures £400 million investment to boost clinical trials, August 2024

9 The Association of the British Pharmaceutical Industry, Creating the conditions for investment and growth, 10 September 2025

10 IQVIA, EFPIA-VE, Assessing the Clinical Trials Ecosystem in Europe, Final Report, October 2024

11 The Association of the British Pharmaceutical Industry, Getting back on track: Restoring the UK’s global position in industry clinical trials, Nov 2023

12 The Association of the British Pharmaceutical Industry, The road to recovery for UK industry clinical trials, December 2024

13 US Food & Drug Administration, Expedited Programs for Serious Conditions | Drugs and Biologics, May 2014

14 Office for Life Sciences, Life sciences competitiveness indicators 2024: summary, July 2024

15 UK Clinical Research Delivery Performance Indicators Reports,

16 Manfrin A, Lee K, Cacou C, et al. Evaluation of the Medicines and Healthcare products Regulatory Agency’s introduction of a risk-proportionate approach for clinical trials: An analysis of 4617 applications assessed between September 2023 and August 2024. Br J ClinPharmacol. 2025; 1-8. https://bpspubs.onlinelibrary.wiley.com/doi/10.1002/bcp.70308

17 NHS England, National contract value review

18 Downing et al. (2016). High hospital research participation and improved colorectal cancer survival outcomes: a population-based study. https://doi.org/10.1136/gutjnl-2015-311308

19 Jonker, L. and Fisher, S.J. The correlation between National Health Service trusts’ clinical trial activity and both mortality rates and care quality commission ratings: a retrospective cross-sectional study. Public Heath, 157 2018 https://pubmed.ncbi.nlm.nih.gov/29438805/

20 The Association of the British Pharmaceutical Industry and Association of Medical Research Charities, Achieving inclusivity in clinical research, June 2025

21 Health Research Authority, Our response to ABPI and AMRC’s report on achieving inclusivity in clinical research, 12 June 2025

22 European Medicines Agency, New targets for clinical trials in Europe, 23 September 2025

23 UK Clinical Research Delivery - Policy Statement - Action to enhance visibility of clinical research delivery against the UK government’s commitment to reduce the set-up time for clinical trials to less than 150 days,

24 NHS England National directive on commercial contract research studies, accessed September 2025

25 UK Clinical Research Delivery - Study Set-Up - Trust level set-up report

26 NHS England Board oversight and staffing of clinical trials, May 2005

27 NHS England, Medium Term Planning Framework – delivering change together 2026/27 to 2028/29, October 2025.

28 HSJ, New DHSC-NHSE top team structure revealed, 26 June 2025,

29 Royal College of Physicians, Physicians’ experiences of clinical research: findings from the three Royal Colleges of Physicians of the UK 2023 census of consultant physicians, 25 October 2024

30 Cancer Research UK, 2023 Survey of the UK Clinical Research Workforce, February 2024

31 Rees, M.R. and Bracewell, M. On behalf of Medical Academic Staff Committee of the British Medical Association, Academic factors in medical recruitment: evidence to support improvements in medical recruitment and retention by improving the academic content in medical posts, Postgraduate Medical Journal, Volume 95, Issue 1124, June 2019, Pages 323–327, https://doi.org/10.1136/postgradmedj-2019-136501.

32 NIHR, 14 new centres to bring commercial research into primary care, 21 October 2025

33 The Guardian, Big pharma firms have paused nearly £2bn in UK investments this year, 16 September 2025

34 Association of Medical Research Charities and Wellcome, Health and growth: How non-commercial clinical research benefits the UK, 18 September 2025

-

ThemeClinical research

-

KeywordsClinical research

-

PublisherABPI

-

Last modified02 December 2025

-

Last reviewed02 December 2025