NHS patients losing access to innovative treatments as UK industry clinical trials face collapse

Patient care, the NHS, and economic growth are all missing out as a result of a collapse in the number of UK industry clinical trials, according to the latest annual report on clinical research from the Association of the British Pharmaceutical Industry (ABPI).

The Covid-19 pandemic has accelerated the decline in late-stage industry clinical research in the UK, compared to its global peers. This should ring alarm bells in the NHS and in Whitehall as health leaders and policymakers look to improve patient care and deliver long-term economic growth. Richard Torbett, Chief Executive, ABPI

The report ‘Rescuing Patient Access to Industry Clinical Trials in the UK’ shows that the number of industry clinical trials initiated in the UK per year fell by 41% between 2017 and 2021, with cancer trials falling by the same margin.

The report also shows that between 2017 – 2021:

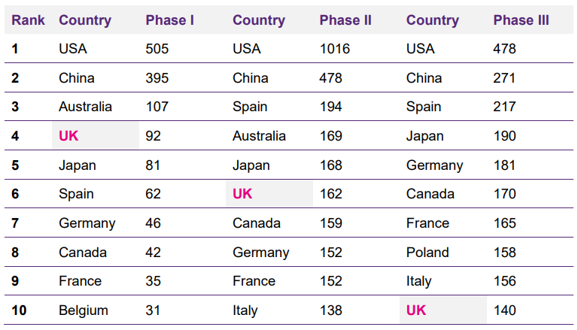

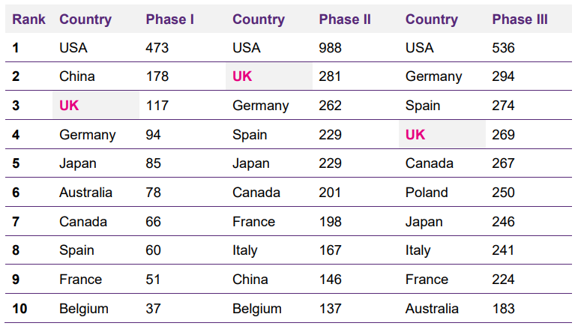

- The number of Phase III industry trials initiated in the UK – those with medicines closest to market – fell by 48% between 2017 and 2021 (Tables 1&2).

- The UK has fallen down the global rankings for late-stage clinical research, dropping from 2nd to 6th in Phase II trials and 4th to 10th in Phase III trials between 2017 and 2021 (Tables 1&2).

- Patient access to industry clinical trials on the National Institute for Health and Care Research Clinical Research Network (NIHR CRN) fell from 50,112 to 28,193 between 2017/18 and 2021/22 – a 44% drop.

These findings point to a clear and serious threat to the long-term future of industry clinical research in the UK – and the benefits it brings to patients, the NHS, and the UK economy.

Patients’ shrinking access to treatments through clinical research is particularly concerning for the health outcomes of patients with limited treatment options in routine care, such as the estimated 3.5 million people living with rare diseases in the UK.[i]

Declining industry clinical trial activity also means less revenue for the NHS. In 2020/21, the loss of industry research during the pandemic is estimated to have generated an NHS deficit of up to £447 million.[ii]

The report found that consistently slow and variable study set-up and recruitment timelines in the NHS are forcing some pharmaceutical companies to place their trials in other countries.

In 2020, the UK's median time between a clinical trial applying for regulatory approval and that trial delivering its first dose to a participant was 247 days, an increase of 25 days since 2018, which drops the UK to 7th place amongst a basket of comparator countries.

This is resulting in fewer opportunities for UK patients and clinicians to access cutting-edge research. It is also causing companies to review their UK research headcounts and risks imminent damage to future investment in UK life sciences.

Richard Torbett, Chief Executive of the ABPI, said:

“The Covid-19 pandemic has accelerated the decline in late-stage industry clinical research in the UK, compared to its global peers. This should ring alarm bells in the NHS and in Whitehall as health leaders and policymakers look to improve patient care and deliver long-term economic growth.

“The time it takes to set up trials and recruit patients in the UK is out of line with our global competitors and is moving in the wrong direction. As a result of this, and growing commercial pressures, pharmaceutical companies are increasingly looking elsewhere when choosing where to develop and launch new medicines and vaccines.

“Reversing this trend will take close partnership between industry and Government, NHS and our system partners. It’s essential that we tackle the urgent challenges facing the life sciences industry to prevent the UK falling further behind its global competitors.”

If the UK can preserve and grow the UK life sciences sector, it is estimated to yield significant benefits, including:[iii]

- An additional £68 billion to the UK economy from increased R&D investment over the next 30 years;

- A 40% decrease in total attributable burden of disease from tackling the UK’s most pressing disease areas.

The ABPI report sets out 11 actions under three themes for the Government and the NHS to take in the next six months to stabilise, and ideally increase, industry clinical trial activity in the UK. These include:

- NHS England and the devolved administrations should introduce a 60-day maximum timeframe, with limited negotiation, for costing and contracting of commercial contract research.

- NHS England should work at pace to ensure all NHS Trusts in England are committed to adhering to prices generated by the interactive Costing Tool for commercial contract research.

- NHS England should incorporate best practices in research finance into its upcoming research guidance for Integrated Care Systems. This guidance should help increase the visibility of revenue generated by NHS commercial contract research and set an expectation that the majority of that revenue is reinvested into research workforce and infrastructure.

Global rankings and number of industry clinical trials initiated in 2021, by country and phase

Global rankings and number of industry clinical trials initiated in 2017, by country and phase

- Clinical research

Last modified: 23 May 2024

Last reviewed: 23 May 2024