Access to innovative cancer medicines transforms lives – helping patients live longer, healthier lives, supporting earlier recovery, and easing pressure on the NHS. By improving how these treatments are valued, funded, and adopted across the health system, we can deliver faster access for patients, better outcomes for families, and a stronger, more resilient life sciences sector that drives the UK’s global leadership in cancer innovation.

This infographic summarises data from the Swedish Institute for Health Economics (IHE) comparator report on cancer in Europe 2025.

Access to cancer medicines in the UK can be limited

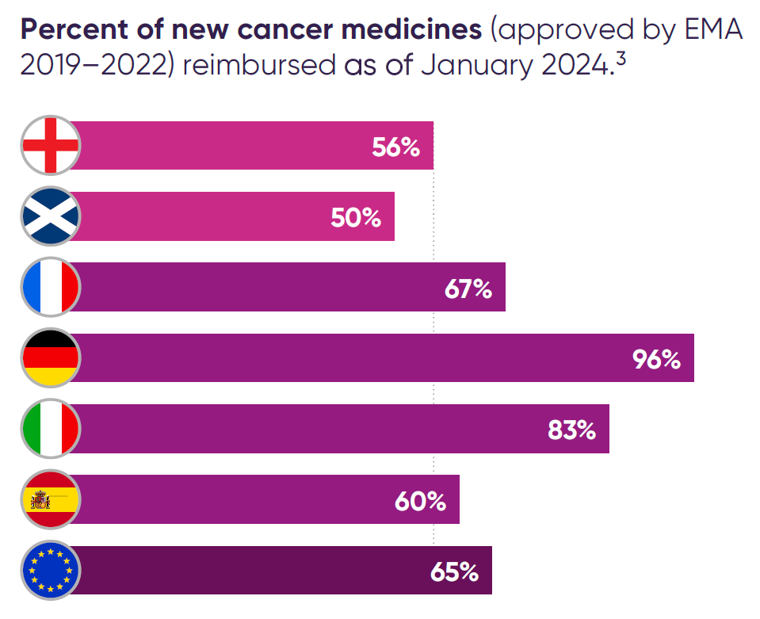

Despite continued advances in cancer research, UK patients can access fewer cancer medicines through the NHS than patients in comparable European countries, as a smaller proportion of new treatments are approved and funded for routine use.

The National Institute for Health and Care Excellence (NICE) assesses the value of new medicines and decides whether they can be funded for NHS patients. Cancer medicines can face substantial challenges in NICE’s evaluation process which can limit patient access to innovative and clinically important medicines in the UK.1

Research from the Blood Cancer Alliance found that blood cancer medicines in the UK face disproportionately high rates of negative outcomes in NICE evaluations, with 44 per cent not recommended and 38 per cent withdrawn during review – limiting patient access compared with other European countries.2

Percent of new cancer medicines (approved by EMA 2019–2022) reimbursed as of January 2024.3

A recent change to NICE’s methods that has been challenging for some cancer medicines is the removal of the end of life modifier which was replaced in 2022 with a severity modifier. The methods change intended to improve access to treatments for severe conditions, but had to be implemented in an opportunity cost neutral way which has meant that some cancer medicines which would have previously met NICE’s end of life criteria are now falling short. This has led to restricted or no access to some cancer medicines, including in breast and gastric cancers.4

The UK is falling behind Europe on cancer drugs

The UK is falling behind its European counterparts in access to cancer medicines. For example, in less a decade, England has dropped from being first in Europe for granting access to new treatments, including for cancer, to sixth for all medicines and tenth for cancer medicines5

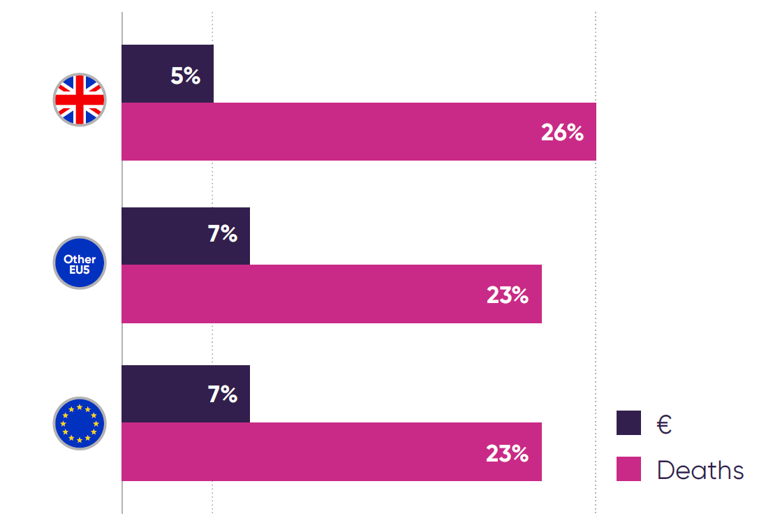

Cancer accounts for a significant share of UK deaths, yet spending on cancer care and medicines is far below the level needed for its disease burden – five times less than cancer’s share of total deaths – and among the lowest in Europe, ranking 13th per patient and lowest among the EU5 (France, Germany, Italy, Spain, UK).

Cancer’s share of total health care expenditure (€) and total disease burden (deaths) in %.

Expenditure data is based on list prices leading to overestimation.

Expenditure data is based on list prices leading to overestimation.

Although survival rates across different cancers have increased or remained stable over the past decade, 5-year survival rates remain alarmingly low for patients in England with cancers such as stomach, lung, and oesophageal.

5-year net survival in England, 2016-2020.

Source: NHS England, Cancer Survival in England - NHS England Digital, February 2023.

Source: NHS England, Cancer Survival in England - NHS England Digital, February 2023.

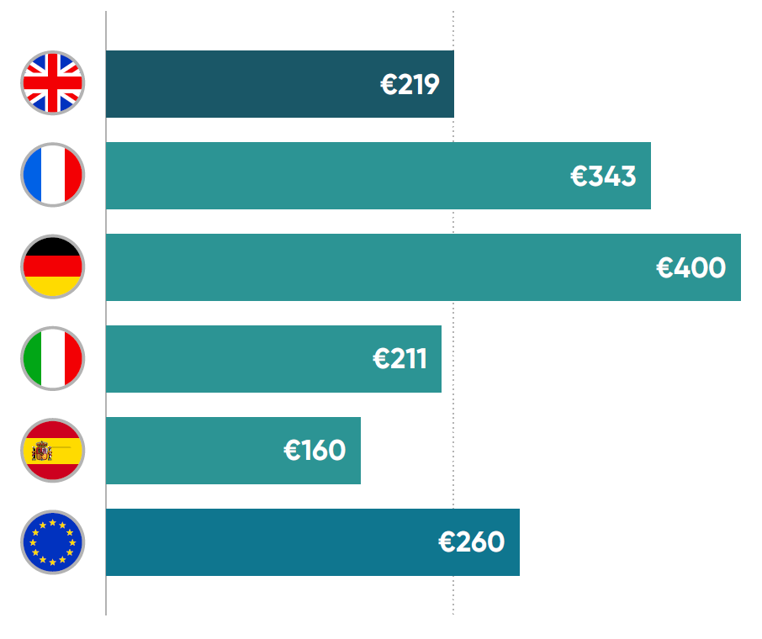

Cancer care spending per capita in euros (PPP-adjusted) in 2023.

Manzano A, et al. Comparator Report on Cancer in Europe 2025 – Disease Burden, Costs and Access to Medicines and Molecular Diagnostics. IHE Report 2025:2. IHE: Lund, Sweden.

Manzano A, et al. Comparator Report on Cancer in Europe 2025 – Disease Burden, Costs and Access to Medicines and Molecular Diagnostics. IHE Report 2025:2. IHE: Lund, Sweden.

Spending on cancer medicines per cancer case in 2023.

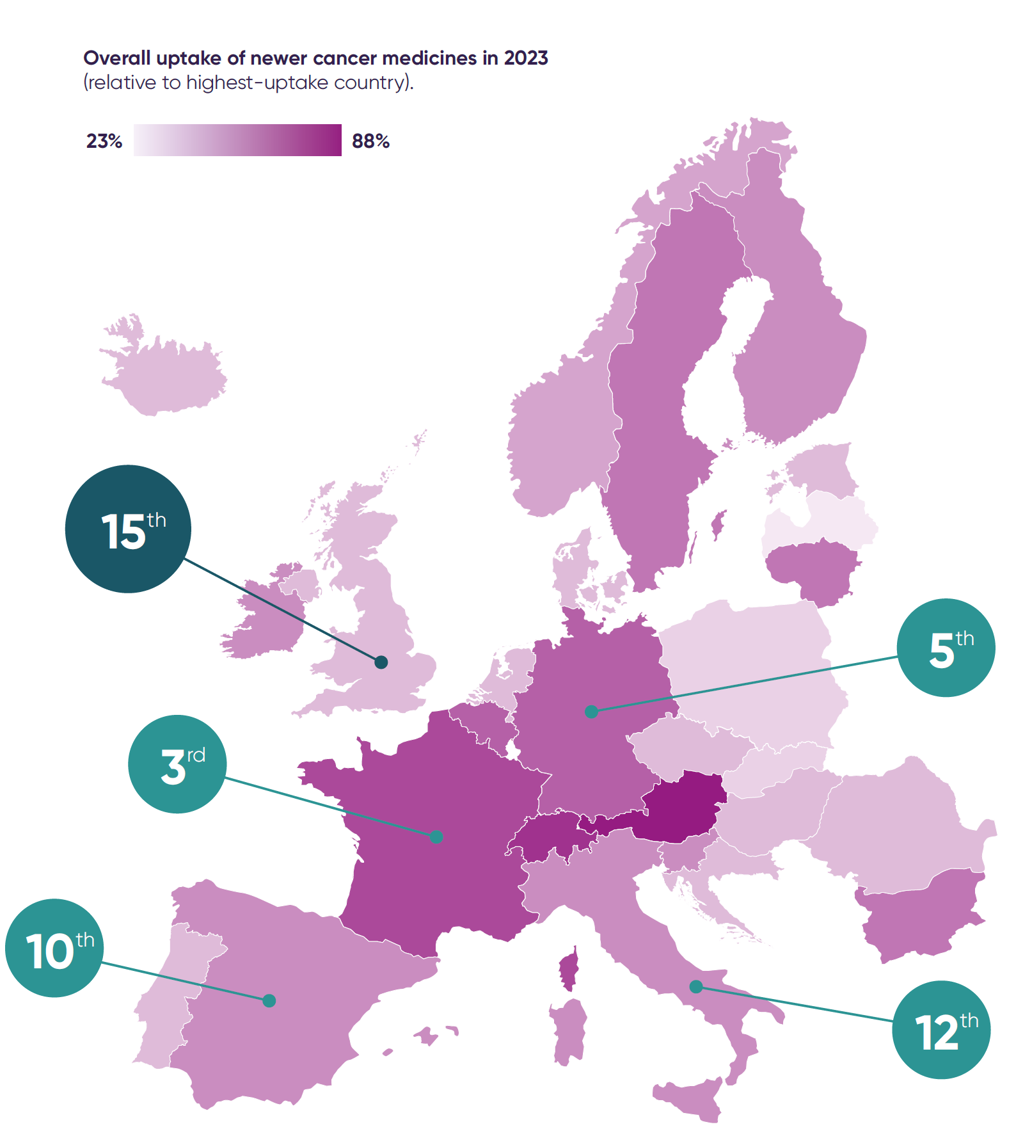

The UK is falling behind other European countries in the use of new cancer medicines, with variable and sometimes slow NHS adoption contributing to inequalities in access and outcomes.

The UK ranks 15th in Europe for usage relative to the number of cancer cases and last among the EU5 countries.

The UK can be consistently slow to use new NHS-approved medicines, with adoption particularly lagging behind other countries in lung, prostate, breast and gastrointestinal cancers.

There is also wide variation in access to modern diagnostics. Many new cancer medicines require molecular diagnostic testing to identify the patients who will benefit. Next-generation sequencing (NGS) is one of the key methods used to carry out these tests.

But regional variation in genomic testing across the UK means some patients still miss out on the medicines best suited to them, with only 0–24 per cent of biopsies in the UK analysed using NGS, compared with over 50 per cent in countries like Denmark and Switzerland.

These barriers not only affect patients but also deter companies from launching new cancer medicines and running oncology clinical trials in the UK. The UK has seen its global rankings for industry clinical trial placement steadily decline since 2018, with early signs of improvement in 2023. Spain, in contrast, has been the number one European destination for industry clinical trials since 2020.6

The solution: increasing investment in cancer medicines and supporting adoption in the NHS

To give cancer patients faster, more equitable access to effective medicines and restore the UK’s leadership in cancer innovation, the government should:

References

- NICE decisions apply in England, Wales and Northern Ireland. The Scottish Medicines Consortium makes decisions in Scotland and has a different decision-making framework.

- Blood Cancer Alliance, November 2025.

- EFPIA, EFPIA Patient W.A.I.T Indicator 2023 survey, June 2024.

- Breast Cancer Now, BCN report and ABPI. CONNIE report#4, September 2025.

- EFPIA, EFPIA Patient W.A.I.T. Indicator 2018 survey, April 2019; EFPIA, EFPIA Patient W.A.I.T Indicator 2024 survey, May 2025.

- ABPI, ‘The road to recovery for UK industry clinical trials’, December 2024.

-

ThemeCancer

-

PublisherABPI

-

Last modified09 February 2026

-

Last reviewed09 February 2026